A drive for efficiency, rapid expansion or technological effectiveness all have been themes in recent CLO investment decisions. In 2012, a rebound in learning spending linked to the U.S. economic recovery drove learning investments. In 2013, the investment focus was relevance, but expanded to content development and technology enablement.

Learning investments continue to grow after notable declines in 2009. Budgets that declined in 2008 and 2009 in reaction to the global financial crisis have grown each year since. Investment in learning technologies and content appear to be priorities. Conversely, performance consulting is declining in importance. Most enterprises expect to continue their technology investments in learning management systems, assessment systems and content authoring and are eager to use delivery modalities such as simulations and mobile learning.

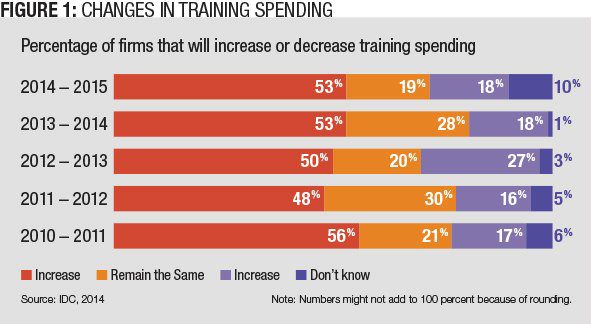

Source: IDC, 2014

Every other month, market intelligence firm IDC surveys Chief Learning Officer magazine’s Business Intelligence Board on a variety of topics to gauge the issues, opportunities and attitudes that are important to senior learning executives. For the past several years, members of the board have provided annual insight into their investment choices. This month the survey on CLOs’ investment portfolio looks at how companies are investing their learning dollars, in what technology and services areas, and where spending will change.

Learning Budgets on the Rise

After a couple of years of decline, some 53 percent of CLOs report for the second year in a row that this year’s budgets were larger than last year’s (Figure 1).

Even more encouraging, last year, of those who reported an increase, CLOs estimated that increase at about 10 percent over their prior year budget. This year the average increase was almost 20 percent. Last year, CLOs who reported a decline estimated their reduction at almost 15 percent. This year that average decline was about 10 percent.

The trend for learning budgets looks good for 2015, too. Almost 55 percent of CLOs expect their budgets to increase in 2015; only about 18 percent expect a decrease. Overall, we project learning budgets for 2015 will again grow about 4 percent on average, with about 20 percent of firms expecting no change from their 2014 budget.

While CLOs generally will see increased budgets, most will focus on improved outcomes and promoting links between learning and business strategy, targeting key investments that support efficiency and relevance.

Learning Needs to Work and Work Well

CLOs continue to be thoughtful with their budgets, spending most on areas that offer tangible results. This approach is reflected in the learning investment areas expected to grow or decline between 2014 and 2015.

Source: IDC, 2014

More than half of CLOs are increasing spending in technology, strategy and performance consulting (Figure 2). This expands on a pattern seen in prior years linking learning to business objectives, and reflects an aim to increase the effect of spending and delivery.

Other budget priorities include:

Learning technology: Assessment tools and learning management systems will be the most significant learning technology investment for most enterprises, though the mix and breadth of learning technology used continues to expand as organizations seek to better evaluate learning in a bid for high performance. Enterprises are also increasing spending on performance support technologies. On-the-job assistance is increasingly recognized as an inexpensive way to increase capability in a workforce with expanding responsibilities.

Learning strategy: More than 50 percent of CLOs are increasing spending on learning strategy. This implies that the distance between learning strategies and organizational success is narrowing. Learning strategy has increased in importance during the prior several years.

Performance consulting: Survey results reflect an early trend toward stabilization in spending on organizational performance, too. About 50 percent of CLOs will increase their performance consulting budget during the next two years. The CLO and the learning organization are often responsible for establishing and managing change initiatives, and performance consulting facilitates targeted improvement and increased business value.

Content development: A core focus for content remains leadership development. As baby boomers retire, learning leaders must prepare the next generation of executives to replace them. Combined with mentors and job rotations, leadership development increases retention rates among mid- and senior-level executives, and helps enterprises ensure the talent and experience they require will be available when needed. Developing blended learning content is also important because organizations want to effectively deliver content, maintain engagement and increase knowledge transfer.

Consistent with last year’s survey, CLOs will invest in blended content, e-learning content and content for leadership and executive development (Figure 3). These areas show an increase in share of total spending and net growth in spending during the past several years. Compared with priorities from previous years, instructor-led training content development remains less important to CLOs. This reflects the continued and growing acceptance of e-learning, and a focus on cost effectiveness.

Spending on certification content appears to be increasing, possibly reflecting the need for relevance and on-the-job applicability. Informal learning content appears to be increasing, acknowledging the preference for informal instruction and the ironic requirement to formalize informal training.

Source: IDC, 2014

CLOs Want Assessment, Technology

Thoughtful introduction of technology is a major source of enterprisewide efficiency, often gained through learning administration. This year, assessment and evaluation technologies are top priorities (Figure 4). Combining learning management with appropriate assessment and evaluation tools can help CLOs target learning for maximum benefit and reduce or eliminate ineffective offerings.

CLOs are also investing in learning technology infrastructure to support wider learning distribution. Though technologies are somewhat behind learning strategy as an overall priority, 57 percent of CLOs see learning technologies as a significant investment area. Organizations are decreasing their use of podcast technologies and content authoring; until recently, both were growing steadily in importance.

In past years, integrated technology products were popular items on the CLO wish list. More recently, fantasy items focused on content management, virtual classrooms, content authoring tools and assessment and measurement tools.

CLOs understand the effect learning can have when it is precisely delivered, hence demand for mobile delivery and virtual instructor-led classrooms, but learning technology without a target can have weaknesses. CLOs sense that through assessment, learning consumed through an LMS combined with learning transferred can produce powerful results.

If money were no object, CLOs would include assessment, performance consulting and analytics on their wish list. Of their needs, two CLOs said: “Get me performance management consulting,” and “I could use competency management and updated performance appraisal tools.” These CLOs are expressing a belief that learning needs to be measured to demonstrate effectiveness and to ensure it meets business goals.

Improving LMS infrastructure is frequently a wish-list item. CLOs often report their desire to have an “LMS/LCMS wholly integrated into the way we conduct business.” But for some, that requires an “upgrade to antiquated technology in the field to be able to better support operations.” Combine those comments with the consistent desire to “Hire more resources to help in the development of e-learning and class curriculum” and it is clear CLOs feel learning management and the proper administration capabilities are high priorities.

Last year, content authoring tools were frequently mentioned on the wish list. This year, those requests got more specific, focusing on content management, instructional design and even e-learning development tools. It seems ad hoc approaches to e-learning content development are insufficient to build and deliver quality learning content for the modern enterprise.

Like last year, a wide variety of CLOs chose to put simulations on their wish list. One CLO said she wanted a “very interactive system designed with millennials in mind.” Another described “immersive learning environment/gaming technologies.” Simulation technology or capability has been on this list for several years, but the bloom may be gone from this particular rose. These requests are specific to particular capabilities as opposed to an overarching desire for simulations.

Overall, CLOs’ wish lists reflect a common desire to manage high-quality learning experiences. CLOs are interested in opportunities to learn from others, like consultants, and in measuring the benefits.

Learning investment priorities are generally consistent with enterprise priorities and intentions, and CLOs are typically conservative when managing these investments. But priorities in investment areas reflect different approaches to meeting enterprise needs. This research suggests learning executives hope to use assessment and performance technologies to improve the effect of organizational learning.