Learning and development organizations are increasingly complicated. Typically, chief learning officers are responsible for learning technology, content development, delivery, and measurement. With the expanding responsibilities, often constrained by budget and expertise, many CLOs use external partners for help with important activities.

How CLOs use partners is almost as complex as learning and development itself. But a deeper understanding about the priorities and pitfalls in learning-business partner dynamics can help CLOs and their partners build more effective relationships.

Every other month, IDC surveys Chief Learning Officer magazine’s Business Intelligence Board to gauge the issues, opportunities and attitudes important to senior training executives. Some 308 members gave their perceptions on how they choose vendors and where they are satisfied and dissatisfied with training partners.

Finding a Quality Learning Partner

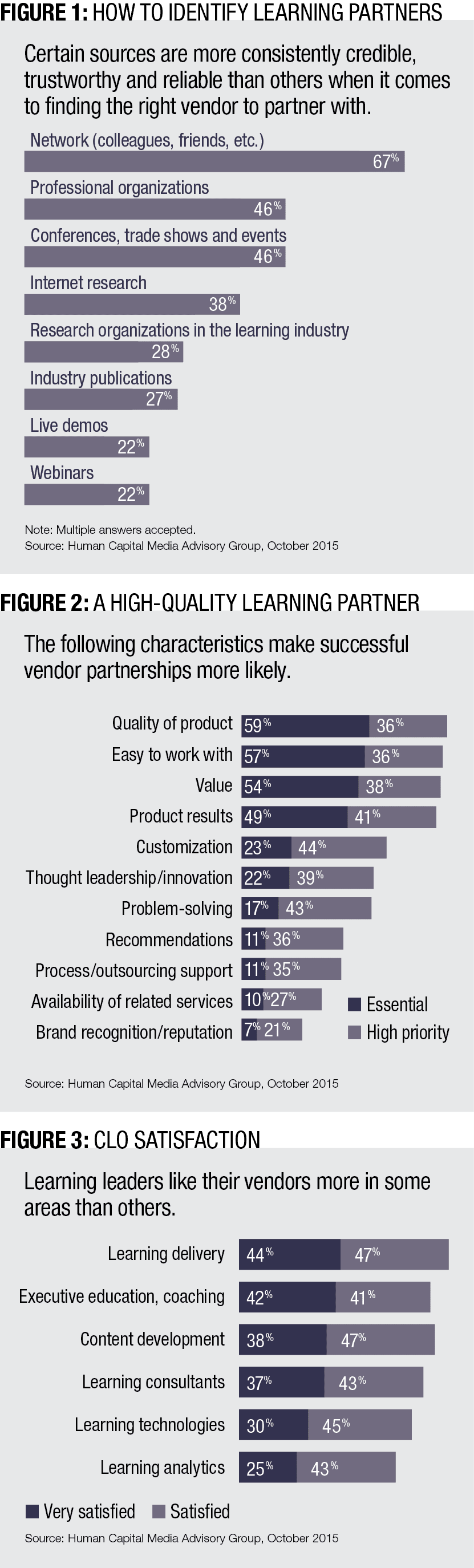

CLOs use all available information when looking for a new learning partner: white papers, analysts, trade shows and professional organizations. Some 67 percent of CLOs also report using use colleagues to identify appropriate learning partners; 46 percent of CLOs use professional organizations; 46 percent use trade shows and events (Figure 1).

While there are many secondary sources to identify appropriate training partners, those sources are frequently used in conjunction with the more personal, trusted sources from their personal and professional networks. Those secondary sources might represent a CLO’s first look at new products, services or vendors, which are then vetted, validated or discarded by recommendations or opinions from trusted sources. The secondary sources also provide CLOs with context for solutions, or they support the selection process. One CLO said she values partners who “share case studies, experience, lessons learned.”

CLOs also use various criteria to assess a particular vendor or product for a relationship after the initial vetting process. While the most important factor in selecting a vendor is the quality of the product or service, three other characteristics are in that top tier: the value, the results produced, and the ease of working with the vendor (Figure 2).

Similar to last year’s results, in the second tier are three characteristics that CLOs value: customization, problem-solving and innovation. Each represents a product or service-enabled approach. Getting the job done matters most, followed closely by the method or approach used to achieve results. The third-tier characteristics are supporting capabilities that lend credibility to the product or services and are tangential to recommendations; related services or support; and the partner’s brand reputation.

While it might be easy to recommend learning partners solely based on quality or results, the second- and third-tier characteristics are also important. Customization, innovation and problem-solving abilities give credit to vendors who stretch the bounds of known solutions.

What Makes a Great Business Partner?

Repeatedly, when asked to describe the challenges learning leaders encounter with their vendors, the issues often revolve around vendor flexibility and the vendor’s ability to listen and respond to specific enterprise issues and customize their solution if necessary. One CLO said in a partner he looks for: “Flexibility and willingness to understand our business and needs vs. sell ‘off the shelf’ material.” Another agreed — it is important that the vendor “understands my business, brings insight, able to work somewhat autonomously with agility and flexibility.”

The third-tier characteristics — recommendations, services and support, and brand recognition — reflect characteristics that can help sell internal stakeholders on the selection. Recommendations can help demonstrate a vendor’s credibility, and support services such as process or outsourcing support, demonstrate a vendor’s confidence making a solution work in the real world.

Several CLOs mentioned customization explicitly when describing their priorities for selecting a learning partner: Willing to customize and help solve the ‘problem,’ not just offer previously used content,” said a CLO at a midsize firm. Another CLO looks for partners who customize and design solutions “to meet specific organizational structures/constraints in a way that best achieves the required end result for the learner.” This makes sense. Even the best relationship is doomed if the product or service is inferior, or fails to provide organizational benefits. A partners’ ability to create products that stretch beyond standard offerings is essential to a CLOs long-term satisfaction.

While it is easy to first find a product and search for just the right circumstance in which to deploy it, that approach is backward. The first step to identify a high-quality product is to first understand precisely what problem should be solved and what the users’ expectations are. Expecting a solution to work outside of that defined set of problems and contexts is a recipe for dissatisfaction. No matter how well a provider’s solution solves the wrong problem, end users will be dissatisfied.

CLO comments on what makes a great business partner reflect the need for alignment between vendor and problem. One CLO said a great partner “aligns appropriate solutions with my organizational needs vs. having a solution looking for a problem to solve.” Understanding specific industry constraints was also a recurring theme. CLOs said:

“The learning vendor must offer training in areas specific to this industry …”

“The ability to customize solutions to meet our industry needs and cost …”

“Experience in our industry sector …”

“A vendor who really knows our industry …”

“A vendor familiar with our industry and our needs …”

“One that takes the time to understand our industry and our culture …”

That need for alignments points to one of the most frequently cited characteristics for a valued partner: A vendor who asks the right questions — and listens to the answers. “Listening to the needs of the client and follows an agile learning development approach.” Another CLO said: “They listen to the needs, learn about the culture and deliver a product that will meet the needs and be accepted.” But the implication is that it goes beyond listening: “Listens and translates needs into a needed outcome.”

In General, Learning Vendor Partnerships Are Successful

CLOs understand the risks of getting highly visible solutions wrong, and many vendors appear to understand it too. Generally, CLOs are quite satisfied with their learning business partners. Nine out of 10 enterprises use external partners/providers for some aspect of their learning and development function — from learning technology, content development or delivery to learning measurement. And more than 88 percent of CLOs report they are satisfied with those providers.

In some learning and development areas, CLOs report even greater satisfaction. In learning delivery, 91 percent report being satisfied with their business partner. More than 80 percent report being satisfied with their executive education/coaching content development, and learning strategy/organization consulting vendors. Far fewer CLOs are as satisfied with their learning analytics providers (Figure 3).

While satisfaction numbers are strong, and learning leaders appear to be satisfied with partner performance, there is room for improvement. While 75 percent of CLOs are either satisfied or very satisfied with their learning technology provider, only 30 percent are “very satisfied.” Worse yet, in learning analytics only 25 percent are “very satisfied,” and another 43 percent are “satisfied.”

For most CLOs, working with learning partners — either for content, technology or services — is a necessary strategy. Maximizing the value of these relationships is essential. The Business Intelligence Board research suggests several strategies for CLOs considering working with vendors:

Before selecting a product or a service provider, it is essential to ensure the organizational requirements are clear in all stakeholders’ minds.

Cultivate a variety of sources and maintain a smaller set of connections to help thoroughly vet a new learning partner. Then, formally and thoroughly assess learning partners before signing a contract.

Finally, even if satisfied with the current team of providers, expect more. There is often more insight, more innovation and more opportunity for value than might be apparent in the first draft of a solution.

By using a wide array of information sources, vetting providers thoroughly and demanding continual insight and innovation from learning providers, CLOs can maximize the value they receive from their learning partners.

Cushing Anderson is program director for learning services at market intelligence firm IDC. To comment, email editor@CLOmedia.com.